Cryptocurrency is reshaping finance, with Bitcoin leading the charge. As a digital currency, Bitcoin operates without a central authority, making it a unique and potentially impactful player in today’s economy. For Boomers, learning about Bitcoin isn’t just about staying current—it’s about being prepared for the digital age.

What Makes Bitcoin Unique?

Bitcoin uses blockchain technology, a transparent ledger that records every transaction. This system ensures security and trust without needing banks or other intermediaries. Transactions are verified and added to the blockchain through a process called mining. This decentralized setup underpins Bitcoin’s reliability and independence from traditional financial institutions.

How to Get Started with Bitcoin

Getting started with Bitcoin is simple. First, set up a Bitcoin wallet, then learn safe practices for buying, selling, and managing your digital assets. This guide will walk you through each step to ensure you can confidently navigate this new territory.

Why Should Boomers Care About Bitcoin?

Bitcoin isn’t just a fad; it represents a significant shift in how value is transferred and stored. As more businesses and individuals adopt Bitcoin, its importance and utility continue to grow. Boomers, as a financially influential group, can benefit from understanding and potentially investing in this disruptive technology.

Diversify Your Portfolio with Bitcoin

Bitcoin offers a new asset class for diversifying traditional investment portfolios. While stocks, bonds, and real estate have been the go-to options, Bitcoin introduces a modern alternative. This diversification can help protect and potentially grow wealth in an ever-changing economic landscape.

The Future of Bitcoin and Personal Finance

Bitcoin’s role in personal finance could expand, and understanding it now can prepare you for what’s ahead. As financial systems evolve, knowledge of digital currencies will be crucial for navigating future opportunities and challenges.

Make your next discovery where science meets surplus. Shop Obtainium

How Bitcoin Works: Simplifying the Complex

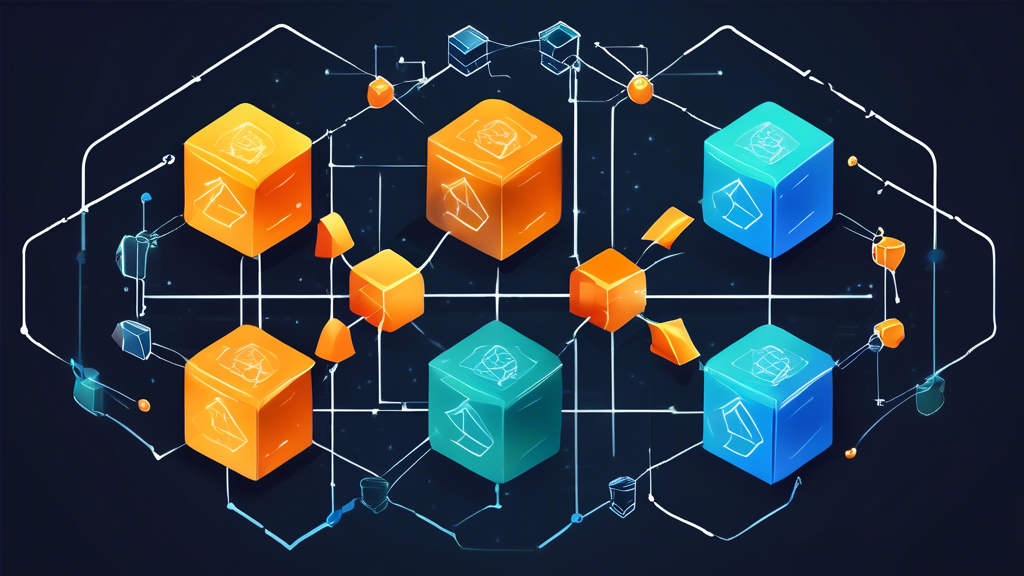

Blockchain is the backbone of Bitcoin. Imagine it as a digital ledger that records all Bitcoin transactions. Each transaction forms a block, which links together in a chain, hence the name blockchain.

Every block contains three key pieces of data: transaction details, timestamps, and a unique code called a hash. If anyone tries to alter a block, its hash changes, breaking the chain and making tampering obvious.

Decentralization and Security

Blockchain is decentralized, meaning no single entity controls it. Instead, it’s spread across many computers, known as nodes. Each node has a copy of the blockchain, making Bitcoin secure and transparent.

Understanding Bitcoin Transactions

Bitcoin transactions start with a digital wallet. A wallet holds your Bitcoin keys: a public key (your Bitcoin address) and a private key (like a password). To send Bitcoin, you enter the recipient’s public key and the amount. Your private key signs the transaction, proving you own the Bitcoin you’re sending.

Nodes validate the transaction, ensuring your private key matches your public key and that you have enough Bitcoin. Once validated, the transaction joins a block. Miners then confirm and record the transaction on the blockchain.

The Role and Impact of Bitcoin Mining

Mining is crucial for Bitcoin’s security and transaction processing. Miners verify and record every transaction, ensuring the blockchain’s integrity. They use specialized hardware to solve complex puzzles, with the first to solve it adding the block to the blockchain. This process, called mining, rewards miners with new Bitcoin and transaction fees.

The Environmental Impact of Mining

Mining requires significant computational power, consuming a lot of electricity. This energy use is often compared to that of small countries. However, some miners are turning to renewable energy to reduce their carbon footprint.

Make your next discovery where science meets surplus. Shop Obtainium

Getting Started with Bitcoin: A Practical Guide

To own Bitcoin, you need a Bitcoin wallet. This digital wallet stores your bitcoins securely. Here’s how to set one up:

Choose Your Wallet Type: Decide between a software, hardware, or paper wallet. Software wallets are apps for your phone or computer. Hardware wallets are physical devices that store your Bitcoin offline. Paper wallets involve printing your private and public keys on paper.

Download and Install: If you choose a software wallet, download it from a trusted source. Follow the installation instructions carefully.

Create an Account: Open the wallet app and create an account. Choose a strong password and store it securely.

Backup Your Wallet: Most wallets guide you through creating a backup, often involving a recovery phrase. Store this phrase safely.

Start Using Your Wallet: Once set up, your wallet will display a public address you can share to receive Bitcoin.

Buying and Selling Bitcoin Safely

Buying and selling Bitcoin is straightforward but requires caution. Here’s how to do it safely:

Choose a Reputable Exchange: Use well-known exchanges like Coinbase, Kraken, or Binance.

Create an Account: Sign up on the chosen exchange and verify your identity.

Secure Your Account: Enable two-factor authentication (2FA) for added security.

Add Payment Method: Link your bank account or credit card.

Buy Bitcoin: Decide the amount and place an order. Your Bitcoin will be transferred to your exchange wallet.

Transfer to Your Wallet: For added security, transfer your Bitcoin from the exchange to your personal wallet.

Sell Bitcoin: To sell, transfer Bitcoin to your exchange wallet, place a sell order, and deposit the proceeds to your linked payment method.

Storing and Managing Bitcoin Securely

Proper storage and management of your Bitcoin protect your investment. Follow these tips:

- Use Hardware Wallets: For large amounts, hardware wallets are the safest, keeping your Bitcoin offline.

- Enable Two-Factor Authentication: Always use 2FA on your wallet and exchange accounts.

- Backup Regularly: Keep multiple backups of your recovery phrase in secure places.

- Stay Updated: Keep your wallet software and devices updated with the latest security patches.

- Be Cautious of Scams: Never share your private keys or recovery phrase. Beware of phishing emails and fake websites.

- Spread Your Risk: Avoid putting all your Bitcoin in one place. Use multiple wallets and exchanges to reduce risk.

- Educate Yourself: Continuously learn about best practices for Bitcoin security.

Make your next discovery where science meets surplus. Shop Obtainium